Options trading allows astute investors to profit on the power of stock price changes. However, investors should be aware that option trading isn't for everyone, and the dangers sometimes outweigh the benefits.

In fact, most option alert services use the standard buying of calls and puts for their simplicity (like The Empirical Collective) whereas others involve very complex options trades (like the article on Chuck Huges optioneering reviews we just wrote).

Options traders must examine a variety of elements, including entry and exit locations, market volatility, and how to put their trading plan into action. This necessitates perseverance, experience, and a basic knowledge of why you want to trade options in the first place.

People who enter into options are traders who aim to profit from stock price fluctuations, according to Dan Raju, founder and CEO of Tradier, a brokerage technology business.

"Options (are) a tool that traders use to control or profit from price movements, and they are essentially restricted by what that price is and how long they have that right," Raju explains.

Optional investments may not be appropriate for all investors. However, if you're wanting to control investment risk and increase profits, options trading has various advantages. Here's more information about options and if they're the proper investing plan for you:

What Are Your Alternatives?

Options are contracts that allow you the right to purchase or sell an underlying asset, such as a stock or an exchange-traded fund, at a specific price over a specific time period.

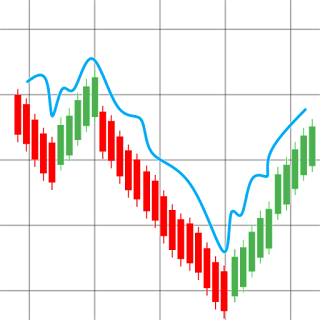

Investors can purchase or sell a security depending on market movements via options trading. If investors anticipate the price of a certain stock will grow or fall, they may use options to profit from that change.

An options contract might be held for a day or a number of years. Participants in the market have the opportunity to execute their options transactions, but they are not obligated to do so. If you want to purchase the options contract, you will pay a higher price.

Options are commonly used to manage risk in the stock market. Investors might use options as a hedge against a declining stock or to reduce risk in a volatile investment.

The pricing of options contracts is influenced by a number of factors. However, many of the same factors that influence the market also influence the price of options. Securities with iconic names or a retail appeal, in particular, have stronger demand in options, according to Raju.

What Is the Difference Between Call and Put Options?

Calls and puts are the two forms of options and they are the most basic trade when it comes to trading options.

Options for making a call You can acquire shares of an asset at a given price, known as the strike price, on or before a certain date, known as the expiration date, with call options. Call option purchasers expect a stock's price to rise in the future, whereas call option sellers expect a stock's price to fall.

When you purchase a call option contract, you are generally purchasing 100 shares of a certain stock for a premium. The buyer makes a profit if the stock's price rises over the strike price. The amount you make after deducting the cost of the premium is your net profit. However, if the stock does not rise over the option strike price, the call option buyer loses the premium paid.

Put possibilities on the table. A put option gives the holder the right to sell stock shares at a certain price on or before a specified date. If you believe the price of an asset will fall, you should purchase put options; if you believe the price will rise, you should sell puts. If the price of a stock falls, owning puts can be advantageous. If you anticipate a stock will decline in price in the future, you can execute your put option when the stock price drops.

Investing in a stock vs. trading options A stock buy differs from an option contract purchase in that a stock reflects ownership in a publicly traded corporation, whereas options are contracts between investors that represent a stake in whether the stock's price will rise or fall.

Comments

Post a Comment